Do You Suffer from Stress & Anxiety???

Are your finances causing you stress and anxiety?

Is your health being negatively impacted from the stress and anxiety you have?

Do you feel like the deck is stacked against you? Do you feel like you are falling behind every day in life and feel a sense of hopelessness? You are not wrong to feel this way!

If you want to know how to alleviate your stress and anxiety and thrive in this world, then you OWE IT TO YOURSELF to watch the videos I have produced. These videos address the issues that are causing your unnecessary stress and anxiety and give you the knowledge and knowhow so you can help eliminate them. But before I begin to enlighten you on the secrets in the videos let me introduce myself.

My name is Jason Shulick and I am The Lifestyle Coach and the Chief Visionary Officer of Andorro.

I have been transforming people’s lives for years by teaching them the principles of money and health that the U.S. Education System refuses to teach us and our kids! Through bestowing my knowledge and instilling my processes to my clients, who are all ages and from all socioeconomic backgrounds, they go from having major bouts of stress & anxiety, feelings of enslavement and sometimes hopelessness to now being in control of their lives. They now control their money and health instead of letting their money and health control them, which alleviated the stresses and anxieties they once had.

These are the same processes and philosophies which I live by that have propelled my net worth from a negative $(25,000) in 2009 to being a Multimillionaire now, have allowed me to take 6 sabbaticals of 6 months or more since I was 28 and maintain a healthy physique!

In my previous life, I fixed and sold numerous companies that were on the brink of going out of business and managed millions of dollars during the past 15 years. In addition, I have worked with numerous high net-worth individuals, private equity firms, and various financial lenders such as Wells Fargo & Bank of America to name a couple.

I received my Masters of Professional Accountancy degree from The University of Texas at Austin (U.S. News and World Report’s #1 ranked school for a Masters in Accounting) and my undergraduate degree in Accounting from Clemson University. I was also one of the original Advisory Council Members for the Masters of Science in Finance program at The University of Texas at Austin and I am a registered Certified Public Accountant (CPA). In addition to my years as working as a restructuring professional, I also served as an Executive Vice President and Board Member for a $45 Million bathroom & kitchen products company and as the Vice-President of Finance for a $30 Million aerospace company.

With all that being said, because of my education, financial knowledge and discipline I have been fortunate to have only lived paycheck to paycheck when I first graduated from college while I was building my war chest!

So, the question is, do you live paycheck to paycheck and have unnecessary stress and anxiety caused from your money and not being financial literate? Well don’t feel bad as you are not alone…

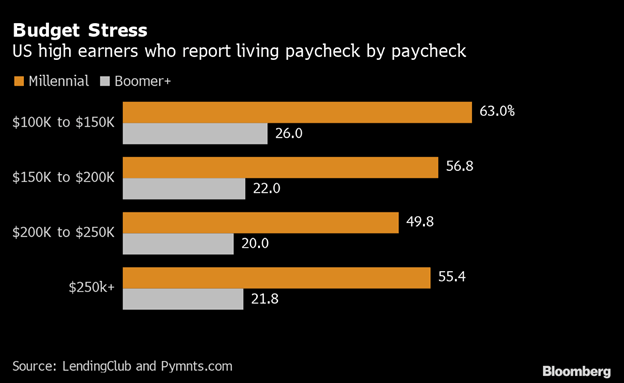

“A larger proportion of Americans are living paycheck to paycheck, a report released Monday by LendingClub and PYMNTS found.

The percentage of U.S. consumers that lived paycheck to paycheck in December (2022) came in at 64%, according to the report. That figure equated to about 166 million and marked a 3% jump year-over-year.

In December 2021, 61% were living that way, the report said.

The report, conducted in collaboration with PYMNTS, polled over 3,900 consumers in the U.S. The surveys took place Dec. 8 to Dec. 23.

Many consumers making over $100,000 per year, 51%, indicated they were living paycheck to paycheck last month, compared to the 42% who said so at the same time the prior year, it also found. Of those, 16% reported difficulties covering monthly bills.

The report showed that for consumers making between $50,000-$100,000, two-thirds lived paycheck to paycheck in December, and over three-quarters (78%) of those earning under $50,000 also said that.”

– FoxBusiness.com 1/21/23

– Bloomberg 6/1/22

-CNBC.com 5/18/22

“The goal of Thriving Wallet, which launched today, is to: “Reframe our relationship with money so that we can reduce financial stress and achieve positive behavior changes,” Arianna Huffington, founder and CEO of Thrive Global, tells Select.

Below, we provide insight into the new Thriving Wallet study:

- 90% of individuals say that money has an impact on their stress level

- About 65% report feeling that their financial difficulties are piling up so much they can’t overcome them

- Roughly 40% report that they are currently taking no notable steps to secure their financial future

- Over 40% wish that they could have a ‘fresh’ financial start

- Less than 25% feel extremely optimistic about their financial future

- Nearly 25% make purchases they later regret when experiencing significant stress

- 40% say managing their money on a daily basis limits the extent to which they can enjoy their day-to-day life”

-CNBC.com 5/18/22

“Finally, Americans’ soft financial literacy skills could also be a factor. Financial literacy has plummeted since 2009, according to a study from the FINRA Investor Education Foundation, and lacking this knowledge could be leading to financial mistakes, including for those earning $250,000 and above.”

– MarketWatch.com 7/5/22

“Indeed, a new National Financial Educators Council (NFEC) survey found that lacking financial literacy — and not knowing how to manage personal finances — carried a high cost in 2022. The NFEC survey showed that 38% of Americans said their lack of financial literacy cost them $500 or more, and a whopping 23% said it cost them more than $10,000 — a steep increase from the 10.7% who said the same in 2021.

As a result, the estimated average amount of money that financial illiteracy cost Americans was $1,819 in 2022 — the highest average since the first annual survey took place six years ago.”

– GOBankingRates.com 1/20/23

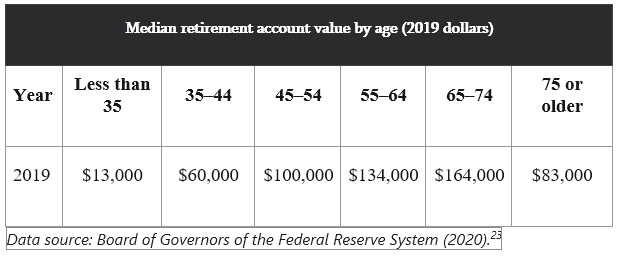

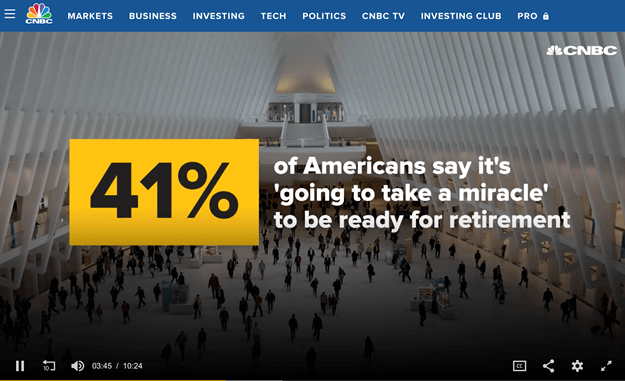

As one can see living paycheck to paycheck and not being financial literate is a problem no matter how much money one makes. If you are living paycheck to paycheck is your lack of retirement savings creating additional stress and anxiety for you? Again, you are not alone as most people are seriously deficient when it comes to having the proper amount of retirement savings as you can see below…

– CNBC 5/18/22

“Americans’ retirement preparedness has dropped and a majority of U.S. adults are now projected to not be able to pay for basic essentials like housing and groceries in their golden years, according to the latest study from Fidelity Investments.

The investment giant’s 2023 Retirement Savings Assessment released Tuesday shows the retirement score for the average American household has dropped into the “fair” range, with more than half of those surveyed, 52%, falling short of having enough savings to cover everyday essentials when they leave the workforce.

Fidelity found that more than a third of Americans, or 34%, will need to make “significant adjustments” in order to afford retirement.”

– FOX Business 3/22/23

And if you are planning on living off Social Security you may want to think again…

“Social Security offers a monthly benefit check to many kinds of recipients. As of October 2022, the average check was $1,676.53 for retirees, according to the Social Security Administration.”

– Social Security Administration, October 2022

With all that being said, I completely understand the feeling can be unbearable for anyone struggling from the stress and anxiety caused by their money or lack thereof. I can relate as I used to experience that unbearable stress and anxiety from when I used to manage my clients’ money or shall I say, the lack thereof. The anxiety and stress from dealing with crisis after crisis was literally killing me.

While my personal finances have always been in order, which I have never had any stress and anxiety from, my former job as a restructuring professional on the other hand was a different story. As the guy that was always in charge of managing the failing company’s money, I had all the stress and anxiety from a situation that I did not even create. My jobs usually consisted of trying to work magic where the companies I would work for would owe like $10 million or more to vendors on top of what they owed the bank, and their customers only owed the company like $4 million. As everyone can see, that math does not work out very well when trying to run a company and keep it from going out of business.

It was grueling week in and week out whether I was going to have enough money each week to be able to pay the vendors I needed on top of making payroll (and you don’t miss payroll). The stress and anxiety I experienced from years of going from one crisis to another was a killer on my body. It got so bad that I was unable to sleep, my hair was falling out, I had serious amounts of inflammation running throughout my body and worst of all, I found out that my adrenal glands had worked so much overtime the prior 13 years dealing with the excessive amounts of stress and anxiety that they were now almost non-functioning, which caused a host of other internal issues that I eventually fixed.

Eventually, the stress and anxiety got to a breaking point and forced me to quit my job. While I was able to quit my job to help alleviate my stress and anxiety, you cannot quit life if your personal finances are creating stress and anxiety for you. Therefore, it is imperative that you have your finances in order to alleviate any stress and anxiety caused by money.

Oh, and as for the health side, yeah, I was that fat kid in high school (at 16 years old I was 195 lbs. at 5’9” and unfortunately it wasn’t solid muscle), which created social anxieties for me as I was not in the popular crowd. It was extremely hard for me to get a date and interact with people. I literally had to ask out 7 girls to get a date to my senior prom. Needless to say, that was a little soul crushing at the time.

Yeah, that was me in my younger years, not exactly at the 12% of body fat I am currently at!

Back then I used to eat like 4 turkey sandwiches, a package of mini-doughnuts, and drink two Hawaiian Punches every day for lunch for years in high school. The garbage my parents fed me and allowed me to eat was so unhealthy, but they didn’t know any better.

Not until I was in the working world and really focused on what I was eating did I understand the damage that I was doing to my body. Through periods of trial and error over the years I was able to really figure out what I needed to do to be healthy and figure out my optimal weight. It took a couple of up and down periods, but since I now understand the principles of food and fitness, I am now able to manipulate my weight easily.

In addition, I also understand how being overweight or obese can negatively affect one’s health as one immediate family member who was obese has type 2 diabetes and the struggles they have to deal with because of that disease. In addition, another immediate family member who is also obese, has other serious health issues because of their weight. Unfortunately, these are not the only health issues that anyone who is overweight or obese has to worry about…

Per the CDC, here is a list of various negative health ramifications correlated with by being overweight/obese that will just add to your stress and anxiety:

- All-causes of death

- High blood pressure

- High LDL cholesterol, low HDL cholesterol, or high levels of triglycerides

- Type 2 diabetes

- Coronary heart disease

- Stroke

- Gallbladder disease

- Osteoarthritis (a breakdown of cartilage and bone within a joint)

- Sleep apnea and breathing problems

- Some cancers (endometrial, breast, colon, kidney, gallbladder, and liver)

- Low quality of life

- Mental illness such as clinical depression, anxiety, and other mental disorders

- Body pain and difficulty with physical functioning

- Increased COVID 19 mortality rate and health issues related to COVID 19

Also, per the CDC 13 cancers are associated with being overweight and obese. The 13 cancers consist of:

- Meningioma (brain cancer)

- Multiple myeloma

- Cancer of the esophagus

- Postmenopausal breast cancer

- Cancers of the thyroid, gallbladder, stomach, liver, pancreas, kidney, ovaries, uterus, and colon.

Most cancers associated with being overweight and obese increased while other cancers decreased from 2005-2014.

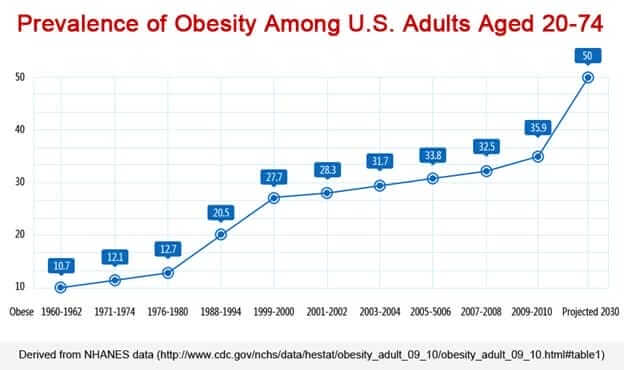

Sadly, being overweight or obese is the norm these days. Per the Center for Disease Control and Prevention (CDC) the “percent of adults age 20 and over that are overweight, including obese, is 73.6% and growing! Of the 73.6% at least 41.9% of the adults are obese.

As for children and adolescents aged 2-19 years in 2017-2020:

The prevalence of obesity was 19.7% and affected about 14.7 million children and adolescents.

Obesity prevalence was 12.7% among 2- to 5-year-olds, 20.7% among 6- to 11-year-olds, and 22.2% among 12- to 19-year-olds. Childhood obesity is also more common among certain populations.

– Centers For Disease Control and Prevention (CDC)

And if you do not get control of your stress and anxiety it could lead to severe health issues!

Once again, I can relate to this firsthand. The night of March 20, 2021, I went to bed feeling great and when I woke up the next morning and could barely get out of bed as my ribs were out of place because of all the inflammation in my tendons in my body. It was extremely painful if the ribs moved a centimeter as they would hit nerves. The pain would send me to my knees, and I was unable to move, which my friends witnessed first-hand. I was afraid to yawn, sneeze or even breath heavy because any major movement would move the ribs and cause excruciating pain. Because of this I had to go to the chiropractor for over 30 straight days to get the ribs pushed back into place each day before they finally stopped dislocating.

While you may look like you are healthy, it’s what going on inside of you that you cannot see that could be the issue. If one does not eat properly, understand how to be fit, exercise properly, maintain a healthy weight and keep their stress and anxiety levels to a minimum, then a bevy of health issues could arise.

On top of causing unneeded stress, anxiety and negative health effects, being overweight or obese also hits those in the wallet more:

“2008’s estimated annual medical costs for an obese/overweight person ran $1,429 per year more than a person at a healthy weight.”

– Centers For Disease Control and Prevention (CDC)

And you know it costs a lot more now that we are way past 2008 as healthcare costs increase exponentially every year!

If you are never taught how to manage money, understand everyday finances such as the importance of your FICO score, and how to create wealth, then you are more than likely always going to struggle, have stress & anxiety and be enslaved to the U.S. Government and your job, one that you may or may not like, because you cannot afford to not have a job!

In addition, if you do not know how food affects your body and brain and you do not know how to be fit, then you are more than likely going to suffer mentally, physically, and financially because of this.

With that being said…

Do you want to know the keys to how I and more importantly, the people that instituted the processes and principles from my videos alleviated their stress and anxiety from money and their health?

While things may seem bleak right now, don’t worry as my knowledge, processes and tools can help you. I know because it has worked with everyone that has gone through the course and followed the processes. It is just going to take a little time and some determination from you. To get you started here are some tips:

To help you solve your financial stresses and anxieties:

- Use tools such as a Cash Flow and a Liquidity analysis to help manage your money.

- Get your FICO score to above 760 because if you don’t it will end up costing you literally thousands of dollars over your lifetime while decreasing your ability to create wealth.

- Determine what you are going to realistically need for retirement and work backwards to figure out how much money you are going to need to invest on an annual basis and the types of investments that will give you the opportunity to reach your retirement goal. Time is against you, so the sooner that you do this, the better off you will be and the more likely you will be able to reach the amount of money you want to have, live the lifestyle you envision and to retire when you want.

To help you solve being overweight/obese and unhealthy:

- Did you know that lack of quality sleep can cause you to gain unhealthy weight and add more stress? Therefore, make sure you get the proper amount of quality sleep each night.

- Eating the proper amount of protein for the weight you want to be is key. By eating the proper amount of protein, you not only feed your muscles, but it takes more energy to burn protein and it reduces your consumption of carbs and fats – all winners!

The videos in my courses will provide you with life changing knowledge and knowhow that you were never taught. They will educate you as to how to control your money and health instead of letting your money and health control you, which will help alleviate the unnecessary stress and anxiety you are feeling so you can live your best life. The courses make sure that you have all the information you need in one spot, so you are not trying to figure out what you need to know and where to get it.

In addition, if you are a parent who does not know this information and has not taught all of this to your kids before they have moved out of the house, then you should provide these courses and videos to your kids to give them the advantages to be able to live their lives to the fullest and eliminate the struggles that most everyone has.

“Conducted by OnePoll on behalf of Experian Boost™, the survey found 81% of respondents agreed they wish they were taught more life skills before graduating college.

The top things pollsters feel left in the dark on included how to invest, long-term financial planning, and the best ways to manage their student loan debt. A further three in 10 regret not learning how to budget.

Nearly one in five (17%) college grads polled still don’t know how to cook or do their own laundry.”

– SWNSDigital.com 10/4/21

Once you gain the knowledge and know how from these videos and implement the processes and knowledge you will notice that your stresses and anxieties will begin to decrease. You will now be in control of your money and your health instead of vice versa. So, in order to meet your specific needs, I have created three courses that can help you:

OPTION #1

THE FINANCE AND HEALTH COURSE WITH “VISION” PLANNING

This tutorial combines all the videos (over 110 videos) and information from the two below individual courses (The Money Management & Wealth Creation Course and The Food & Fitness Course). This tutorial will teach one the skills needed for life more than any class or classes one will take in school. In addition, the Vision exercise I use with my clients is taught to help one determine the path(s) one needs to take to drive their life forward.

Finance

- How to Manage Money Properly (Budget, Cash Flow Analysis, Liquidity Analysis, Net Worth Analysis).

- Cash Flow Analysis Example

- Budget Example

- Liquidity Analysis Example

- Net Worth Analysis Example

- Credit Report/FICO Score Importance.

- Credit Cards vs Debit Cards.

- Checks/Bank Accounts.

- Housing (Renting, Owning and all that is related to a mortgage and owning a home).

- Retirement Overview (Planning, Types of accounts, etc…).

- Investing Principles and Investment Options (Stocks, Bonds, Crypto, etc…).

- Taxes (Federal, State, Social Security, Medicare, Sales, etc…).

- College (Is it worth it).

- Student Loans (Types, Are they worth it, etc…).

- Capitalism/Socialism/Communism Pros and Cons.

- Health Insurance Overview.

- Life Insurance Overview.

- Other Insurances Overview (Renters, Supplemental, etc…).

- The Importance of the Federal Reserve.

- Supply and Demand Economics Overview.

- Economic Reports.

- Wealth Creation (Mindset, Leverage, Risk, etc…).

- Strategy for Managing Credit Card Debt and Other Debt.

- And More…

Health

- Overview of the Overweight/Obesity Crisis, what caused it and how to avoid being a part of it.

- Cause of Obesity and the negative effects of being Overweight/Obese.

- What is a diet?

- Understanding Macros.

- Effect of food on the brain and body.

- Organic vs Non Organic and what Organic means.

- Pros and Cons of Alcohol.

- Pros and Cons of Marijuana/THC.

- What is intermittent fasting.

- Overview of how to cook and what basic tools are needed.

- Kitchen Safety.

- What does being fit mean?

- Effects of exercise on the body and brain.

- BMI and Body Fat % targets.

- Importance of Sleep.

- Importance of Stretching.

- Importance of Water.

- Benefits of Meditation.

- Effects of Aging.

- Health Markers to Track.

- And More…

Vision Planning

- Vision Planning

OPTION #2

THE MONEY MANAGEMENT & WEALTH CREATION COURSE

This tutorial, which is over 80 videos, will provide one with the tools and knowledge about everyday finances, how to manage money and then what it takes to create wealth. It will help one alleviate their stress and anxiety related to money issues. The main topics covered in this course:

- How to Manage Money Properly (Budget, Cash Flow Analysis, Liquidity Analysis, Net Worth Analysis).

- Cash Flow Analysis Example

- Budget Example

- Liquidity Analysis Example

- Net Worth Analysis Example

- Credit Report/FICO Score Importance.

- Credit Cards vs Debit Cards.

- Checks/Bank Accounts.

- Housing (Renting, Owning and all that is related to a mortgage and owning a home).

- Retirement Overview (Planning, Types of accounts, etc…).

- Investing Principles and Investment Options (Stocks, Bonds, Crypto, etc…).

- Taxes (Federal, State, Social Security, Medicare, Sales, etc…).

- College (Is it worth it).

- Student Loans (Types, Are they worth it, etc…).

- Capitalism/Socialism/Communism Pros and Cons.

- Health Insurance Overview.

- Life Insurance Overview.

- Other Insurances Overview (Renters, Supplemental, etc…).

- The Importance of the Federal Reserve.

- Supply and Demand Economics Overview.

- Economic Reports.

- Wealth Creation (Mindset, Leverage, Risk, etc…).

- Strategy for Managing Credit Card Debt and Other Debt.

- And More…

OPTION #3

THE FOOD & FITNESS COURSE

This tutorial, which consists of over 30 videos, will provide one with the knowledge about how food and exercise influence the body and brain, cooking basics and what it means to be fit. The main topics covered in this course:

- Overview of the Overweight/Obesity Crisis, what caused it and how to avoid being a part of it.

- Cause of Obesity and the negative effects of being Overweight/Obese.

- What is a diet?

- Understanding Macros.

- Effect of food on the brain and body.

- Organic vs Non Organic and what Organic means.

- Pros and Cons of Alcohol.

- Pros and Cons of Marijuana/THC.

- What is intermittent fasting.

- Overview of how to cook and what basic tools are needed.

- Kitchen Safety.

- What does being fit mean?

- Effects of exercise on the body and brain.

- BMI and Body Fat % targets.

- Importance of Sleep.

- Importance of Stretching.

- Importance of Water.

- Benefits of Meditation.

- Effects of Aging.

- Health Markers to Track.

- And More…

Look, I can tell you all day that the information, processes, and tools that are provided will transform your life and will help to eliminate your stresses and anxieties. But don’t take it from me, take it from a few of the people who decided they wanted to change the direction of their lives and implemented the knowledge and processes from the courses…

Elizabeth (Age 29), Server

Phoenix, AZ

“First, I am so happy I get to tell my story and hope it will enlighten others that can relate to my situation. So let me set the stage for you…I am a single 29-year-old server that makes about $40K who now lives at home with my parents because of the financial situation I created for myself as a very young adult. I have gone through all the lower-level situations when it comes to money. I come from a blue-collar family, and we really did not have much. My dad had little to no money most of the time, and my mom slaved to make things “work” as a single mother. So, in a nutshell – healthy money habits, consistency, and confidence weren’t instilled in my subconscious. And as I grew into an adult, that subconscious mimicked the habits and mindset of my parents. Therefore, I had ZERO control over my money, which meant that I had ZERO control over my life. My life encompassed “the struggle” in both childhood and adulthood…

In my mid 20’s I lived in Los Angeles chasing a dream that turned into a nightmare because of my finances. Sadly, I got used to getting a 3-day notice letter taped onto my apartment door because I was late on rent almost every month. It was embarrassing for everyone to see that walked by, but I just couldn’t figure a way out. During that time, I was also on the verge of getting my car repossessed, constantly had to figure out how to survive on $40 for the week and all my credit cards were maxed out and overdue. At times, I didn’t have enough gas money to get to the various jobs I would book. All because I was in way over my head, living a lifestyle that I couldn’t afford and not knowing how to properly manage money.

In early 2022, understanding I needed help with my life, I went out and hired a so called “life coach” to help guide me and set me up for success. I paid this life coach $2,000 and unfortunately, they did not set me up for success and did not provide solutions to my problems as all they did was say go get a higher paying job.

Then in August of 2022, the restaurant I was working at had to suddenly close for 9 days. The staff was given last minute notice, and I was informed that I would not be getting paid for those 9 days. While I was glad to be given a much-needed break, I started to stress as I begun to worry about money and thought to myself if I had I only saved for rainy days like this. I got upset at myself for not being fiscally prepared for a situation like this. During that time, I mustered up some motivation and bought a few books about money, but once again another resource was of no help as they didn’t really teach me how to properly manage money and how to solve my issues related to my debt. Two different times I sought help and got none, so hope was dwindling.

Then when I got back to work, I ran into one of the regulars at the restaurant and told him about my situation. He told me that he could help me if I wanted his help and was willing to listen to him, so I took him up on his offer.

When I began with Jason in September of 2022, I had all of $200 in my bank account and all 3 of my credit cards were maxed, which was about $7,000. This credit card debt was in addition to the student loans, car loan, and the current and past due taxes I owed. Jason and I went through all my accounts as well as what my life currently looked like on an overall scale. We talked about where I ultimately wanted to be at the end of 2023 and what I needed to do to get there.

After that, Jason sent me the easy-to-use financial workbook that would basically become my financial bible. He showed me exactly how to use the workbook and informed me that tracking everything would be crucial to my future success. He laid out the reality of my situation and helped me understand that sacrifice is where it’s at in life. He stressed that anyone could sacrifice things in the short term, and I learned that once you begin to see progress, the sacrifice just gets easier. Once I finally saw and understood where all my money was going, I began cutting out all the unnecessary expenses and started to aggressively pay down my credit card debt and past due taxes (because the interest I am paying on my credit card debt is INSANE).

The financial tools showed me where all my money was at at any point in time. I also learned to better understand when my money was tight and when I had cushion. I was able to analyze all my spending habits on a 12-month scale and account for all the work I was doing. With the knowledge instilled in me by Jason, in just a three-month period, I took my credit card debt from $7,000 to $2,338, paid off all but $300 of the past due state income taxes I owed and ended the year with $1,770 in my bank account (up from the $200 I started with). By the end of June 2023, I should have all my credit card debt paid off along with all the past due state income taxes, the $2,000 of current taxes due for 2022 and have about $6,000 in my bank account. I know this because the tools he provided me that I use every day show me. So now I don’t stress about money because I know what I currently have and what I plan to have every two weeks.

Also, like most women, I have aspirations of getting married and having kids, so I feel it’s imperative to have my financial house in order as I want to have a successful marriage since money is the #1 cause for divorce, and I do not want my kids to grow up struggling the way I did. In addition, I want to attract a guy that has his financial house in order, and I don’t think I can do that without mine being in order first.

We also began talking about what improvements I want to make to my health as he stressed that is more important than money. I would say I was in decent shape, but I wanted to get back to being toned and sculpted. While I felt I ate healthy in general, I really didn’t know how to eat properly and the effects the foods I was eating were having on me. At the beginning of October, I was 135 lbs so I determined I wanted to get to the weight that made me feel my best and have the most confidence. Therefore, I set my goal to be 128 lbs. Jason inspired me to make that goal by December 31st. He reiterated to me that when I lose weight make sure that it is fat and not to burn through my muscle. He taught me how to eat so that I would minimize any muscle loss. I made my weight goal by cutting to 127 lbs. on the very last day of the year. I now feel and look great, so my goal now is to sculpt and tone a little more and not lose any more weight.

The best part of all this is I accomplished all this success on my own! I just needed the knowledge and the tools. I now feel I have control over my life and where I want to go. My next focus is learning how to create wealth for myself so I will be prepared for retirement and will not have to struggle like my parents have.

Now many of us come from a similar background and have a similar mindset, and I will note now that if you don’t find a way out of these habits, then you’re in for a very difficult time down the line.

I now reflect from time to time that if I had only had the opportunity to have learned all this information when I was just starting out as an adult, I would not have had to endure all the stress, anxiety, and bad experiences my money or lack of money created for me and how much closer I would be to being financially free.

Unfortunately, school doesn’t teach us this information and prepare us for the adult world. I feel Jason is teaching people for the greater good and am very appreciative of the knowledge he has provided me. Anyone who doesn’t understand money truly needs the information in the courses he provides as everyone deserves to know how to manage their money properly, create wealth, stay in good health and have control over their life. And once you start doing the work, your confidence and mindset shifts, rises, and things finally begin to change.

With all that being said, his ability to provide the right tools, the right information and to be able to teach it is truly an amazing gift, which has completely transformed my life!”

John (Age 50), Doctor

Phoenix, AZ

“I’m a 50 year old optometrist who has earned millions of dollars over the past 25 years. However, when I met Jason, I was living paycheck to paycheck and my liquidity and net worth were both at a negative $(35,000). By following Jason’s fiscal tutelage, the past 12 months I have since increased both my liquidity and net worth to $135,000 (a positive change of $170,000) and created a savings plan to buy my last house. Needless to say, he has changed my life as he taught me how to understand my business financially, to manage my money properly, to create wealth, to plan for retirement and how everything flows together. In addition, by following his methodologies and financial advice I was also able to raise my credit score from 620-770! Because of his teachings, I have reduced my anxiety and stress levels and I’m now achieving the financial freedom I desire.

As for the fitness aspect, before I met Jason I was approximately 12% body fat, health conscious, living a high-fitness lifestyle, but I used to eat out every meal. Because of the knowledge bestowed upon me about the effects of food, cooking and food prep that Jason instilled in me, I was able to take my fitness to another level. I learned how food could not only be healthy but could also taste delicious! With my knowledge of understanding my body and understanding how to fuel my body the healthy correct way it has propelled me to be in the best shape in my life at 50 years old! I now eat great tasting meals that are healthy and in effect I reduced my bodyfat to 9%.

After making these changes fiscally and physically, it has impressed upon me to pass this on to my children. My parents, being both physicians, instilled many great values like education and self-determination, but they never taught me the fiscal aspect in order to create wealth. Hence, I wanted to share this knowledge with my children (21 and 24 years old) so that they could start life off in the right direction and not struggle like I did. So, I setup meetings with Jason to mentor them. My son, who accepted Jason’s help, really benefited because he implemented the knowledge and methodologies and is currently thriving in both areas of his life. As for my daughter, who declined his help, she consistently struggles to make her monthly rent and pay her bills. I tried to impress upon her that I have made over $2 million dollars in my life with not much to show for and I wanted her to have this knowledge that I wish that I had when I was younger so she would stop struggling. With that said, as I continue to thrive, hopefully it will inspire her to eventually take her finances seriously and take me up on my offer so she will stop struggling.”

Maria (Age 36), Dancer

New York City, NY

“Where do I start…I grew up in Brazil very poor, so I moved to NYC for a better life. When I got to NYC my job options were limited so I started dancing in the clubs and have been working in the clubs for over 8 years now. Like a lot of people in my industry, I was irresponsible with my money squandering it on unnecessary extravagant items. In addition, I also made some bad investments in Brazil because of my lack of financial knowledge. All that hard work all those years and I had barely anything to show for it because of those bad decisions. Then a couple years back I was introduced to Jason and my life completely changed!

Since working with Jason (about 2 years now) I now understand how successful I am, how much money I make, how to manage it and how to grow it. He has completely changed my mindset and educated me about money, which has allowed me to strive for more because I now know I can do it. Never would I have thought I would have the net worth I have now and that I would have the ability to obtain my future net worth goal. Knowing that a dancing career has a shelf life, he has helped me start on my next career so when my dancing career ends, I will be able to transition into my next career without any interruptions.

I tell him I wish I had known him 5 years ago because if I did, I would have complete financial freedom at this point in my life. He tells me once he has taught me everything I need to know, and I have mastered the principles of managing my money and creating wealth that his job will be done and I will need to fire him. However, no matter how much I have mastered everything he teaches me I will never fire him because his knowledge and ability to challenge me pushes me harder each day to create a better life for myself.”

Tirrell (Age 27) & Aga (Age 25), Real Estate Broker & Uber Eats Driver

Charlotte, NC

“Before Aga and I met Jason we had over $25,000 in old credit card debt and were living paycheck to paycheck. To say the least we had our fair share of stress and anxiety because of money, which of course added unneeded stress to our marriage. Since we had a newborn, we thought it would be best to get help and get our financial house in order so we reached out to Jason.

Through his mentoring and taking us through his Money Management and Wealth Creation course we now understand and practice his principles of how to manage money. Because of this we were able to eliminate all of our credit card debt, build a 6-month emergency fund, and contribute the full amount to our Roth for 2021 ($6,000) so we can start creating more wealth when we feel the time is right to enter the stock market. All of this was accomplished in just 6 months of working with Jason.

Because of the knowledge and practices gained from Jason, my wife and I communicate about our budget and our financial goals better than ever before and we rewarded ourselves with a 10 day financially stress-free vacation to Tulum and Playa Del Carmen, Mexico.

With all that being said, we look forward to continuing our financial journey with him with our monthly calls and learning and implementing more from his Money Management and Wealth Creation course so we can continue to build our liquidity and net worth.”

Cole (Age 20), College Student

Santa Barbara, CA

“My dad introduced me to Jason back in March of 2022 giving me the opportunity to learn from him as he thought it would be beneficial since Jason coaches people on the skills everyone needs to know that are not taught in school. Being a college student, my dad felt that working with Jason could help me grow and prepare me for life right now and particularly after school when I am on my own. Because I am fortunate to still be supported by my parents, it is allowing me time to master the principles on how to manage money and understand what it takes to create wealth so when I graduate and start my career, I will be educated about how to make money, how to manage it and how to grow it so I will be able to support myself and not struggle with my finances.

He is also helping me understand the effects of food and how to eat as I have a goal of getting my weight up to at least 185 lbs by adding lean muscle (I am 6’3” and weighed 145 lbs when I was introduced to Jason). In the five months I have been working with him, I have added approximately 20 lbs of lean muscle. In addition, he has me thinking about what kind of goals I want to have at this stage in my life (financial, health, and lifestyle) and understanding the various paths I can take to achieve them. While my goals will change over time, the ability to determine my goals and understanding how to determine the path(s) that will allow me to achieve them is the real take away. Lastly, while my parents always share their wisdom to help me, I am grateful that my dad introduced me to Jason as he gives me a different perspective on how to be successful and maximize my life.”

Tim (Age 44), Managing Partner of a Healthcare Consulting Firm

Atlanta, GA

“Back in my mid 30’s and when Jason lived in Atlanta, we used to hit the gym together frequently. At that time in my life, I was in pretty good shape. Then life happened. I started up a consulting firm, got married, and had two kids. As my life began to change, Jason, in search of bluer skies and limitless golf options, departed for Arizona. Over the years I would work out here and there; you know, I would get on those kicks for a month or so just to see it fade quickly after a couple weekends out of town or a busy summer hauling the kids around—truly a far cry from the times when Jason still lived in Atlanta.

As Jason and I remain friends, after all everyone needs a loyal golf buddy, I recently visited him in Arizona for a golf outing and noticed that he and one of his AZ golf buddies (who is in his 50s) were in pretty good shape for their ages. I was interested in how they maintained their bodies, so we got to talking about their workout routines and what they were eating; which basically amounted to a discussion about Jason’s Food & Fitness Course. As expressed by Jason, while working out was important, he reiterated to me that it was 80% about the food/diet and 20% about the workouts. Since I was staying with him, I got to experience firsthand the diet he incorporated into his life. Instead of going out to eat, he cooked at home to show me that healthy food could taste good and didn’t need to break the bank. This golf trip inspired me to get back to focusing on my health, and thus I asked for his workout routine, general meal plans and a copy of the Simple, Healthy & F*%king Delicious cookbook so that I could start to get back to where I wanted to be physically and more importantly be able to maintain it.

Since I have incorporated Jason’s workouts, focused on my diet, and implemented some of his other advice related to food and fitness, I’ve seen a lot of progress. I think, ultimately, my biggest takeaway is that I feel better and have much more energy than I did before subscribing to Jason’s plan. Now, my next goal is to see if I can kick Jason’s ass at golf like I once used to… and while the new exercise and diet plan will help, I have a sneaky suspicion my only chance would be a move to Arizona.”

As you can see, these are people of all ages and from all socioeconomic classes that have benefited from the knowledge and processes bestowed upon them from these courses! Therefore, what would you pay to not have the stress and anxiety in your life caused by your money and health – $1,000… $5,000… $10,000… can you really put a price on your happiness and being in good health? Because this is essential information everyone needs to know, I have decided to make it affordable so everyone can benefit from it. Therefore, THE FINANCE AND HEALTH COURSE WITH “VISION” PLANNING, which is normally valued at $624.99, can be yours today for just $499.99 (Payment Options as low as $41.67/payment*), a 20% discount! , (Use Coupon Code: NOMORESTRESS)

This course is NOT some 30 min video. Again, it is a compilation of over 110 individual videos to help you easily understand the following:

- How to Manage Money

- Every Day Financial Information

- How to Create Wealth

- How Food and Exercise Influences the Body and Brain

- Cooking Basics

- What it Means to be Fit

- Understanding What it Takes to Achieve Your Goals to Live Your Best Life &

- How the U.S. Government Will GIVE You a FREE $2,000 annually for Your Retirement Savings (find out how to qualify)

And if you feel you only need to alleviate stress and anxiety from your finances, THE MONEY MANAGEMENT & WEALTH CREATION COURSE (over 80 videos) can be yours today for $399.99 (Payment Options as low as $33.33/payment*), or if you just want to focus on your health, the food & fitness course (over 30 videos) can be yours today, for $299.99 (Payment Options as low as $25.00/payment*), a 20% discount off the retail prices of $499.99 and $374.99! (Use Coupon Code: NOMORESTRESS) In addition, to all these videos, which you will have LIFETIME access to, you will receive the following BONUSES:

THE FINANCE AND HEALTH COURSE WITH “VISION” PLANNING

- A downloadable Personal Financial Excel Model that includes a:

- Budget template

- Cashflow Analysis template

- Liquidity Analysis template

- Net-Worth Analysis template

- 15 & 30 Year Amortization Tables for Mortgages

- A 15 yr vs 30 yr Mortgage Analysis

- A downloadable Vision Planning template

- A downloadable version of The Simple, Healthy & F*%king Delicious cookbook

THE MONEY MANAGEMENT AND WEALTH CREATION COURSE

- A downloadable Personal Financial Excel Model that includes a:

- Budget template

- Cashflow Analysis template

- Liquidity Analysis template

- Net-Worth Analysis template

- 15 & 30 Year Amortization Tables for Mortgages

- A 15 yr vs 30 yr Mortgage Analysis

THE FOOD & FITNESS COURSE

- A downloadable version of The Simple, Healthy & F*%king Delicious cookbook

Ask yourself, isn’t your mental health, overall health and financial well-being worth a mere $9.62 per week, less than the cost of a Chipotle Burrito?

These discounted prices will only be good for the first 1,000 customers, so act now!

Every day you let go by is one less day you could have been working to eliminate your unnecessary stress and anxiety. Remember, time is the one thing that is against you so do not hesitate to get your hands on these videos now!

If you have any questions, feel free to email me at support@andorro.com.

Simply click on the button below for the exact course you want, and it will take you to your order page.

Option #1

$499.99 regular price $624.99

SAVE $125 (20%)

USE COUPON CODE: NOMORESTRESS

Payment Options as low as $41.67/payment*

Option #2

$399.99 regular price $499.99

SAVE $100 (20%)

USE COUPON CODE: NOMORESTRESS

Payment Options as low as $33.33/payment*

Option #3

$299.99 regular price $374.99

SAVE $75 (20%)

USE COUPON CODE: NOMORESTRESS

Payment Options as low as $25.00/payment*

*Payment amount determined by final sales price, approved interest rate & number of payments